Commodities Trading

Trade the ebb and flow of global supply and demand with Equities Reserves’ low spreads and advanced platform.

What Are Commodities?

Commodities trading has been an essential part of human history since the days of exchanging spices and cowry shells. It is widely believed that commodities trading began in Asia hundreds of years ago. In today’s financial markets, commodities are mainly traded in two forms: cash settlement and forward settlement. In cash settlement, the clearance date is in the near future, whereas, in a forward settlement, the clearance date is way further in the future and prices usually have wider spreads. There are different types of commodities traded: Energies such as oil and natural gas; Precious Metals such as gold and silver; Agricultural Products such as coffee, wheat, and sugar; and Livestock and Meat such as pork bellies and feeder cattle.

A Case of Stock Trading

The most popular way to trade commodities is through futures contracts where there is an agreement to buy or sell a particular amount of the underlying commodity for a specific price at a later date. Futures exchanges standardize the minimum quality and quantity of a commodity to be traded. For instance, at the Chicago Board of Trade, one standard wheat contract represents 5000 bushels. There are two types of traders in the commodity futures market: buyers and producers, as well as speculators. Buyers and producers use the futures market as a way of hedging against changes in prices, and this group of traders makes or takes delivery of the tangible commodity when the futures contract expires. For instance, a sugarcane farmer may wish to hedge against future price losses before harvesting. The farmer will sell sugar futures contracts during the planting season, thus guaranteeing a pre-set price when the crop is harvested. The other group, speculators, seek to benefit from the price changes of futures contracts. They will close their contracts before the due date and will never make or take deliveries. Commodities are a popular tradable asset class on our platforms. We offer commodity spread bets and CFDs on both cash and forward commodities such as gold, silver, Brent, and WTI Crude oil.

Why Trade Commodities with Equities Reserves?

-

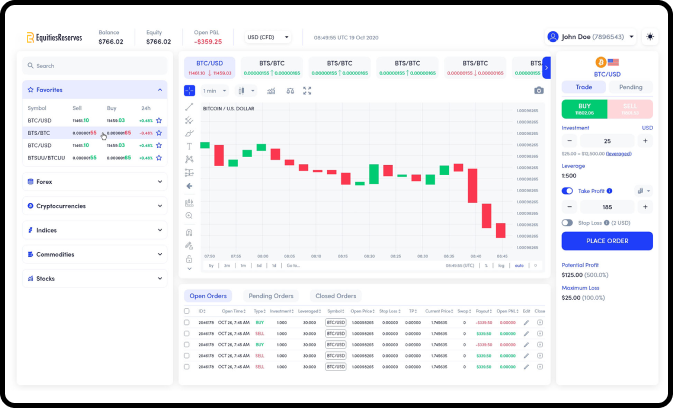

Advanced Trading ToolsEquities Reserves provides its customers with the most advanced web trading platform in the market.

Advanced Trading ToolsEquities Reserves provides its customers with the most advanced web trading platform in the market. -

Trade From AnywhereEquities Reserves web trader can be accessed from anywhere in the world and from any device.

Trade From AnywhereEquities Reserves web trader can be accessed from anywhere in the world and from any device. -

Trading ExpertsOur professional brokers are here to help you succeed. Your win is our win!

Trading ExpertsOur professional brokers are here to help you succeed. Your win is our win! -

Award Winning ServiceOur award-winning support agents are at your service, 24 hours, 5 days a week.

Award Winning ServiceOur award-winning support agents are at your service, 24 hours, 5 days a week.

Live Commodities Price Ticker

Trade the ebb and flow of global supply and demand with Equities Reserves’ low spreads and advanced platform.

An Incredible Platform for Every Trader

The Equities Reserves trading platform is tailored to the modern trader’s lifestyle. It’s slick, stylish, and easy to use, but still possesses all of the most advanced analytical tools a professional trader may need to execute even the most complicated of strategies. Equities Reserves is the platform of choice for countless traders worldwide.